maryland electric vehicle tax incentive

Here at Prince Frederick Ford we pride ourselves in placing our local Blue Oval Emblem shoppers behind the wheel of their favorite new Ford model. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

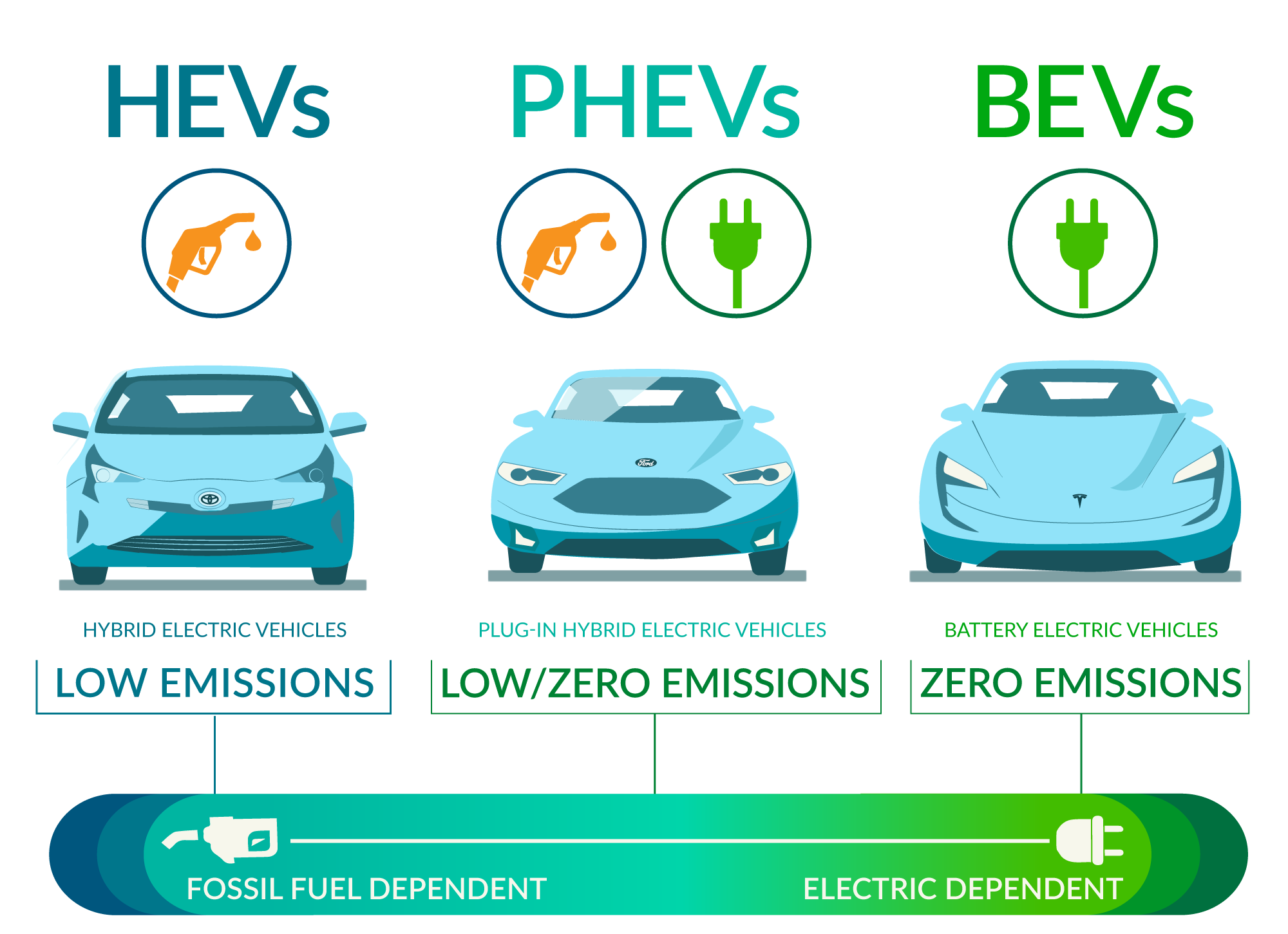

Ev 101 What You Need To Know About Electric Vehicles

ChargePoint is providing information on this tax credit only and is not the issuer of the tax credit.

. By 2020 the combined market share of plug-in electric and hybrid vehicles reached 5 placing Colombia second after China among developing countries Figure 1. Local and Utility Incentives. Income Tax Credit - Wineries and Vineyards.

There is a variety of HEV types and the degree to. Click on the icon for your Adblocker in your browser. Canadian automakers breathed a sight of relief Thursday after US.

Incentives are available on a first-come first-served basis. Find research resources and locate an attorney specializing in research. Tax Credits - Electric Vehicles - Extensions.

Search what is available in your area by entering a zip code below. Although Pohanka Hyundai in Capitol Heights Maryland is not open 24 hours a day 7 days a week our website is always open. This incentive originally expired on December 31 2017 but was retroactively extended through December 31 2021.

Illinois doubled its gas tax in 2019 from 19 cents to 38 cents per gallon which incentivizes drivers to. Tax credits may be available for the purchase and installation of EVSE make-ready infrastructure in commercial buildings up to 1500 or up to 3000 if the infrastructure is in affordable housing. The 7500 US credit for clean vehicles which include battery-electric plug-in hybrid and hydrogen fuel cell is part of.

Research lawyer attorneys law and legal research information. Go to IRSgovOrderForms to order current forms instructions and publications. Heres how to disable adblocking on our site.

Through the programs below MEA helps Maryland residents businesses non-profits and local governments implement energy efficiency upgrades and. A Rivian electric vehicle factory is under consideration for construction in North Texas and could possibly rival Teslas electric vehicle plant or Gigafactory. Must purchase and install by December 31 2021 and claim the credit on your federal tax return.

One-time tax credit up to 3000 Eligible for HOV lane. Budget Reconciliation and Financing Act of 2013. How to Use Your Tax Refund at Pohanka Hyundai of Capitol Heights near College Park MD.

Electric Vehicles Solar and Energy Storage. Maryland Electric Vehicle Supply Equipment EVSE Rebate Program. A credit is available for the purchase of a new qualified two-wheeled plug-in electric drive vehicle.

Details are yet to be revealed on the full incentive package offered for Rivians plant in Georgia but the company could obtain full benefits of the states mega project tax. The credit is for 10 of the cost of the qualified vehicle up to 2500. State EV Charging Incentive.

The type of vehicle you choose and your tax circumstances impact the incentive you qualify for. Where Can I Charge My Electric Vehicle. If your employer provided you with a vehicle and included 100 of.

After Colombia implemented these tax policies we saw a major increase in electric vehicle sales. Income Tax - Business and Economic Development - Cybersecurity Investment Incentive Tax Credit. This tax credit is available for all taxable years.

The US Federal Tax Credit gives individuals 30 off a ChargePoint Home Electric Vehicle charging station plus installation costs up to 1000. Ordering tax forms instructions and publications. Must purchase and install by December 31 2021 and claim the credit on your federal tax return.

This information provides an overview of laws and incentives and should not be your only source of information for making decisions about vehicle purchases taxes or other binding agreements. Under this program the purchase of a new electric vehicle is eligibe for a tax credit worth 7500 as long as it meets the following criteria. This rate offers incentives in the form of reduced utility bills to customers that charge their EV during off-peak hours.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. The full incentive is available for electric vehicle EV charging stations rated with power capacity of 75 kW and higher and a 60 incentive is available for ports rated 50 kW to 74 kW. Federal Electric Car Incentive.

A drop down menu will appear. Lawmakers scrapped part of a massive incentive package for electric vehicles that would have excluded those assembled in Canada from a proposed consumer tax credit. Market Share of Electric and Hybrid Vehicles in Colombias New Vehicle Market.

A hybrid electric vehicle HEV is a type of hybrid vehicle that combines a conventional internal combustion engine ICE system with an electric propulsion system hybrid vehicle drivetrainThe presence of the electric powertrain is intended to achieve either better fuel economy than a conventional vehicle or better performance. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. For questions or to submit an incentive email the Technical Response ServiceFor additional incentives search the Database of State Incentives for Renewables Efficiency.

Hyundai IONIQ 5 Dealer near Washington DC. Or our Parts Department at 240-788-4249. Electric Vehicle Charging Time of Use Rate.

Federal incentives for electric vehicles. The Maryland Energy Administration manages grants loans rebates and tax incentives designed to help attain Marylands goals in energy reduction renewable energy climate action and green jobs. Combined with incentives in some states these tax credits have been helpful but electric vehicles still make up only a few percent of all vehicle sales.

Welcome to Prince Frederick Ford Your Go-To Ford Dealer Serving Prince Frederick California Dunkirk Solomons Island and All Throughout Southern Maryland. The US Federal Tax Credit gives individuals 30 off a ChargePoint Home Electric Vehicle charging station plus installation costs up to 1000. Call 800-829-3676 to order prior-year forms and instructions.

The Corporate Average Fuel Economy CAFE standard was revised and rebranded as the Safer Affordable Fuel-Efficient vehicle standard with significantly weaker energy efficiency targets for model years 2021-2026 than those established under the CAFE standards10 In 2020 a federal tax credit of up to USD 7 500 for the purchase of an electric. A federal EV tax credit program offers up to 7500 depending on your situation. The federal electric vehicle tax credit up to 7500 is.

Payments are made annually from the date equipment is placed in service through 2025. Getting more electric vehicles on the. The IRS will process your order for forms and publications as soon as possible.

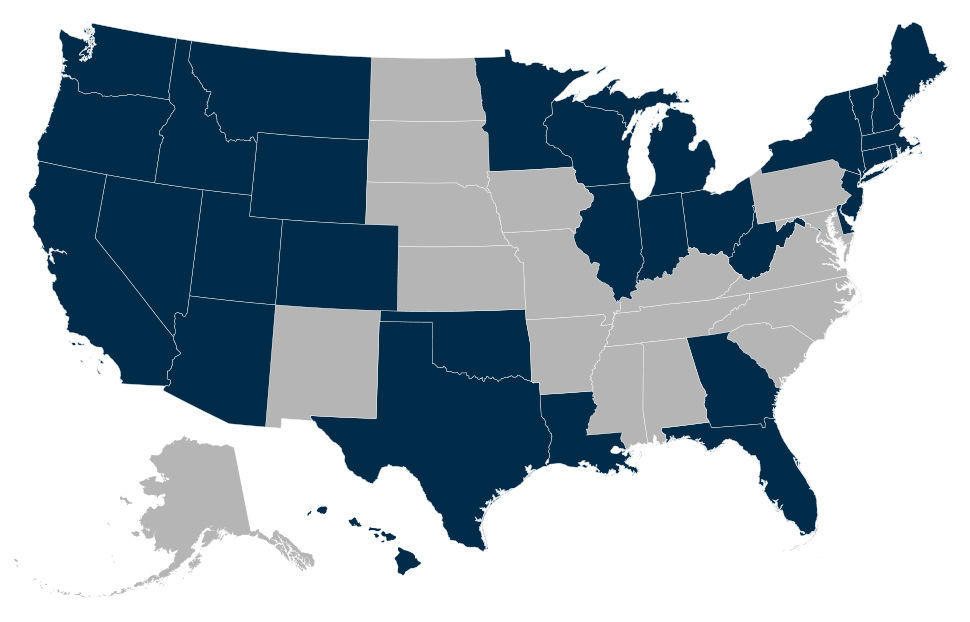

In addition to broad-scale electric vehicle incentives states and utilities provide incentive programs rebates and tax credits specifically for purchasing and installing EV charging equipment across the country. We see a new Ford in your future. Federal and State Electric Car Tax Credits Incentives Rebates.

BGE offers customers the opportunity to enroll their eligible smart Level 2 chargers in an Electric Vehicle Charging Time of Use Rate through a simple two step process. The Qualified Plug-in Electric Drive Motor Vehicle Tax Credit is the main federal incentive program for electric cars available in the United States. ChargePoint is providing information on this tax credit only and is not the issuer of the tax credit.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicle Incentives By State Polaris Commercial

Incentives Maryland Electric Vehicle Tax Credits And Rebates

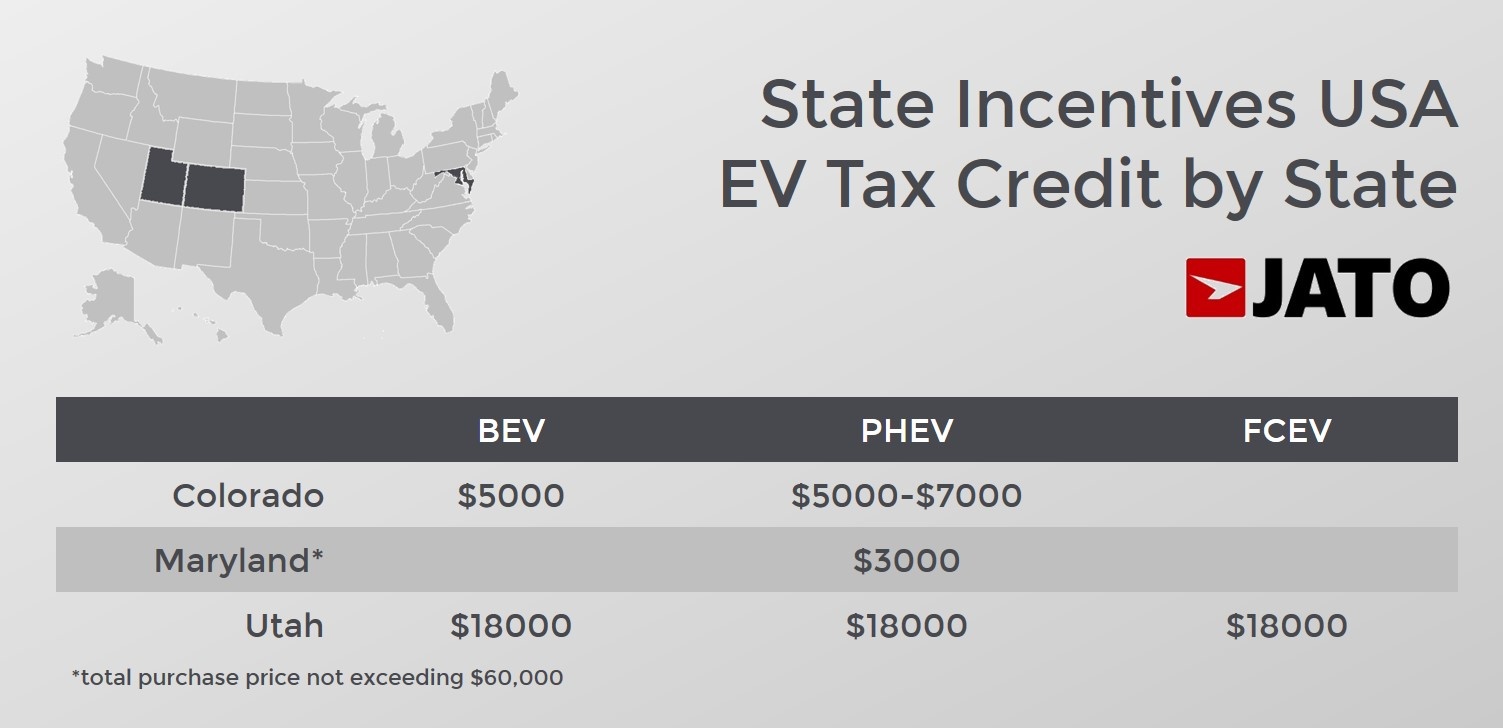

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Electric Car Tax Credits What S Available Energysage

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Incentives Maryland Electric Vehicle Tax Credits And Rebates

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Rebates And Tax Credits For Electric Vehicle Charging Stations

Incentives Maryland Electric Vehicle Tax Credits And Rebates

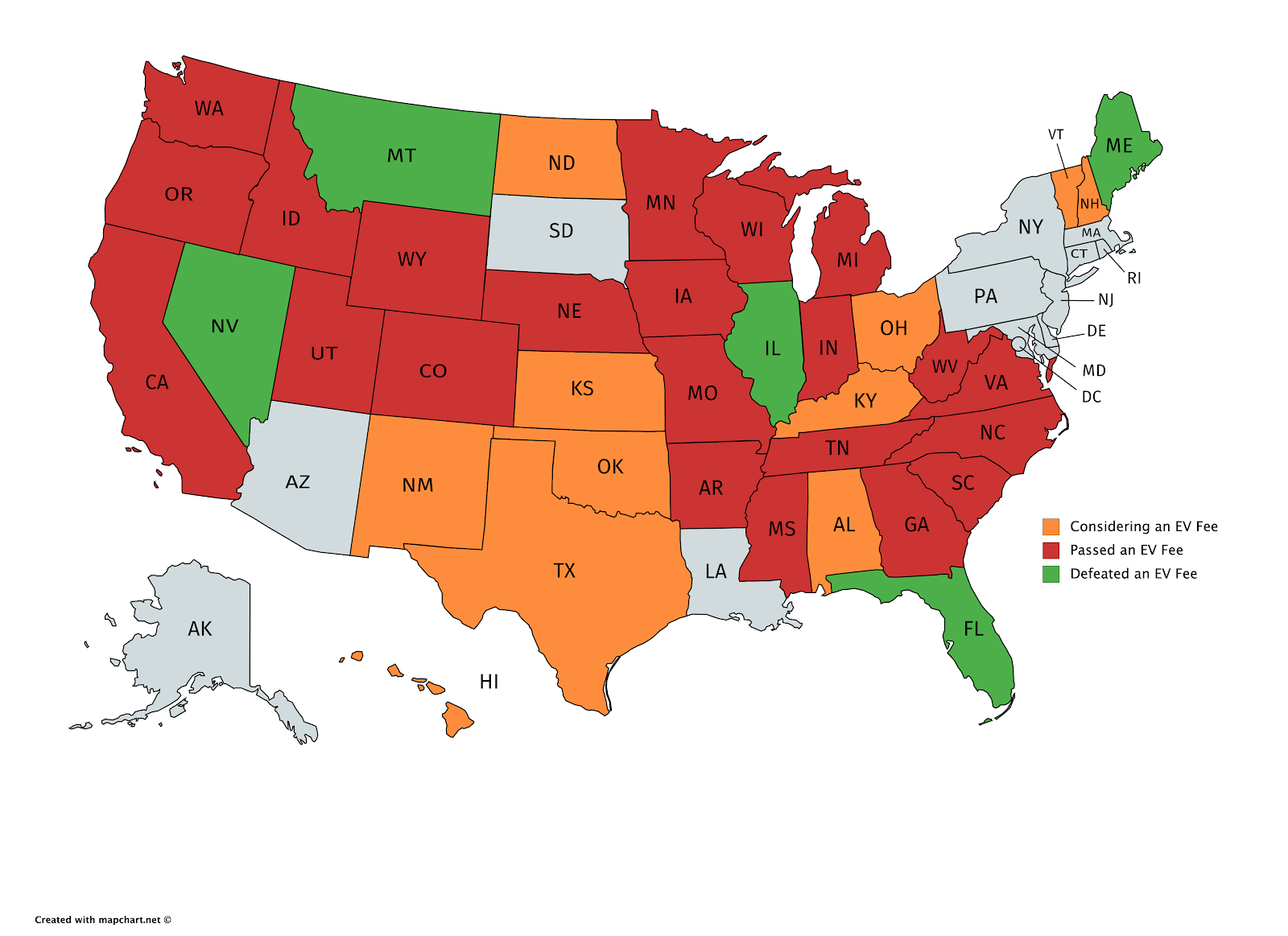

Don T Be Fooled Annual Fees On Electric Vehicle Drivers Are Not Fair Sierra Club

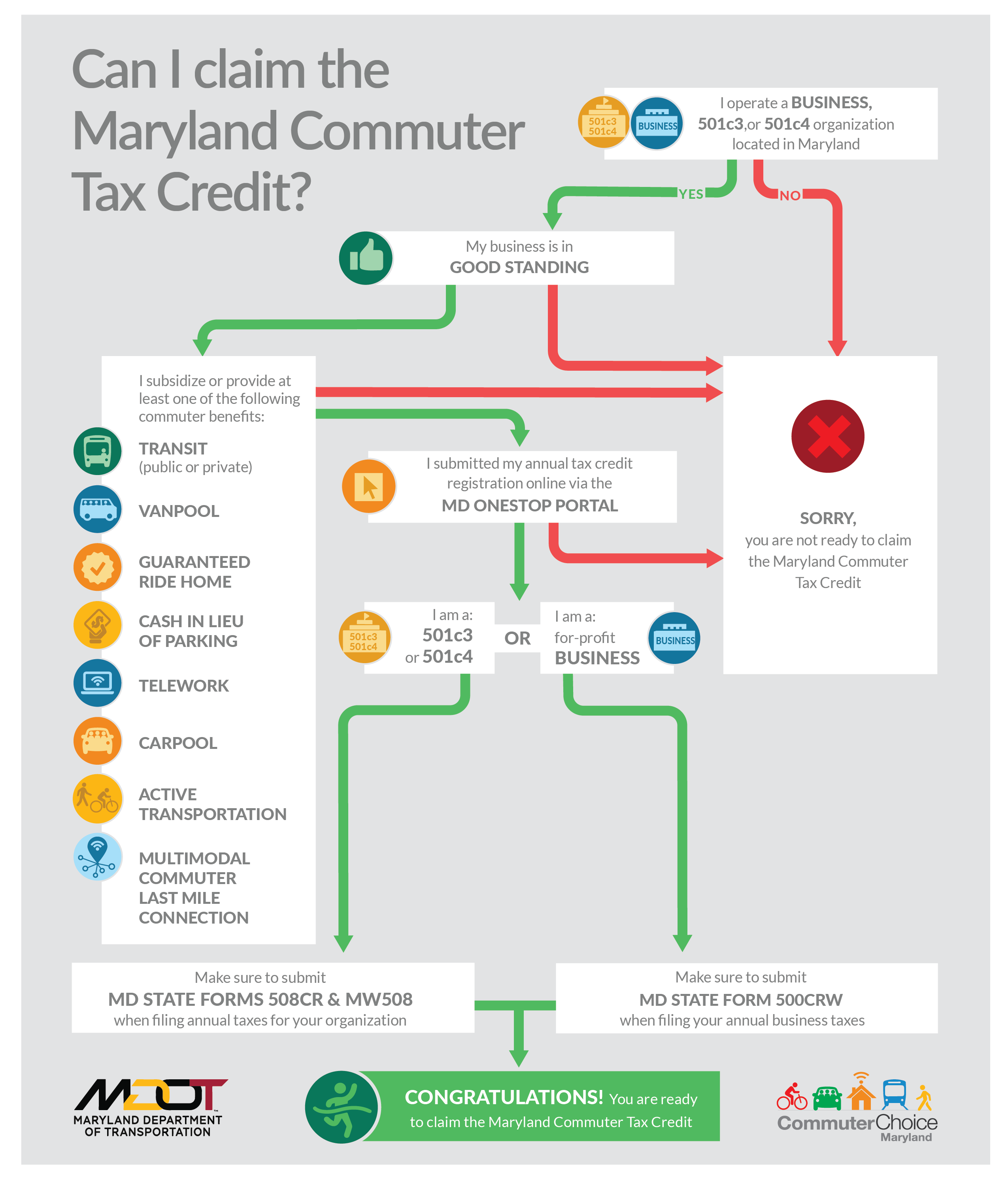

Maryland Commuter Tax Credit Mdot

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates